Minds + Machines (MMX) is a gTLD (generic Top Level Domain) investment vehicle listed on the AIM under MMX.

Firstly, a gLTD is the suffix to a domain name, such as .com, .xyz, .vip etc. In around 2008, ICANN decided to open and publish new gLTDs through an application and auction process. The owner of the gLTD typically sells domain name rights on an annual (think lease) basis to customers (so for instance enabling Mike to have his website domain name as mike.vip).

MMX is interesting as it is the only pure-play publicly listed vehicle with a portfolio domains. This prose will explore the company and assess it as a investment given the recent interest from Investors Chronicle and heaving buying on the exchange. There are no comparable public companies - MelbourneIT (ASX) and GoDaddy (LSE) operate in the domain registrar market however don’t traditionally own the underlying gLTD.

A Quick History

The company has been around for a while but recently relisted on the AIM in 2014. Prior to this MMX announced a war-chest of approximately $63 million to contest various TLD applications. Since successfully contesting various domain auctions, MMX has typically historically provided registry ownership and management of its own gLTDs. In the last financial period it announced an intention to scale back its own registry services, relying on others and focussing on managing its portfolio of gLTDs.

The MMX portfolio is currently focused around geographic domains, professional occupations and consumer interests with the gems of the portfolio being .london, .vip and a few interesting domains still under contest. MMX also manage various gLTDs for partners.

Market Overiew

Typically when a customer purchases the domain name, they purchase this through a registry and rely domain management services. Previously MMX developed and maintained their own systems for this process, however going forward MMX is focusing on management and relying on the efficiencies of other registrars to maintain the customer facing systems. This is the correct decision with the registrar business being very competitive and low-margin. MMX is building demand through effective sales strategies and keep the P&L trimmed by focusing on their portfolio.

There are a number of contested domains, which include .home and .inc which may prove to be winners. MMX have cash (>$40mm) to potentially win these which may provide further upside.

Underlying costs to maintain gLTDs with ICANN are about $25k p.a and about $0.25 per domain name. However the main cost contributor for MMX are advertising and promotion to draw in customers to consider a new gLTD.

How to look at the business

I believe the company should be looked at some sort of property fund. Instead of renting out assets, MMX ‘leases’ domain names within their gLTD portfolio. The return which MMX gets depends on the retention of existing customers, market demand and pricing. MMX have exclusivity over the gLTD, no one else can have a .vip domain name without going through MMX.

Therefore the underlying assets should be looked with a discounted cashflow basis. However this is where the difficulty comes in - gLTDs are pretty new and are somewhat intangible with no proven track record. ~60% of new gLTDs are being registered in China.

Competitors

There are no other pure-play publicly listed gLTD portfolio companies in which we can easily assess the value of such a portfolio.

The largest and most similar private company, would have to be Donuts Inc. Founded at a similar time and raised ~$150mm since then with a portfolio of gLTDs most notably, .guru, .email and .company all with circa 50k registrations.

The Portfolio

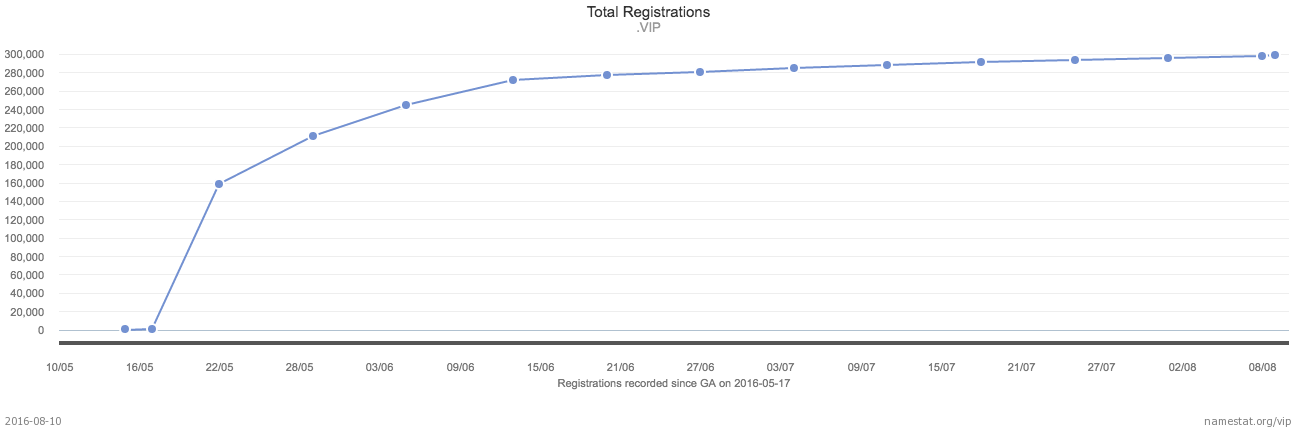

One should look no further than .vip domain name, with over 300k registrations particularly strong in Asia.

Historically it is showing little churn, with on average positive growth of approximately 300 new registrations per day. In the 28 July 2016 press release MMX was quoted as saying ‘billings have increased over 300 percent’ and domains under management have grown by 236 percent. This indicates the most of this growth is from new domains, and particularly auctions of high value domain names.

A number of domains in contention (including .inc) are currently in auction with the results pending, MMX still have significant cash to pursue or else will likely receive cash back. .购物 [.shopping] has also recently been granted and provides interest, it is too late to make an impact in H1 FY2017, but may be a solid performer in H2.

Balance Sheet Strength

Cash Balance

Significant cash holdings, this includes cash held by ICANN related to contested gLTDs

-> $42.8mm of cash and a total of 767,119,685 shares on issue. This equates to 5.5c (4.3p) per share in cash.

Intangible asset balance

Note that all of these gLTDs were acquired in the last few years, show no sign of impairment and are valued at cost. Potential further upside here.

NTA Basis

On a complete net tangible asset basis: -> $79.027mm of assets and a total of 767,119,685 shares on issue.

This equates to 10.3c (7.9p) per share in NTA.

Repurchases and Management Buying

Repurchase averaged at 8.6p per share. This is about a 10% discount to the current share price.

Both Mr Elliot and Mr Hall acquired approximately half a million shares each at around 10p average cost, similar to current market rates.

Tidying of P&L

Headcount has been reduced from a high of ~61 to around 25. This should improve both the gross margins and some trimming of the operating expenses. Cited to have a $4.5mm cost reduction across the FY17 financial year.

FY16 half year results are due to be announced next month. The latest press release cited H1 billings increasing by 300% to $8mm USD. Growing from $5.9mm in the second half of FY15 (40% increase).

FX Exposure

The majority of the sales and income are denominated in USD, therefore likely to see some potential gains in FX compared to previous years. MMX do not use trading derivatives, so therefore MMX is somewhat attractive in this relatively recessionary UK market.

EBITDA Model

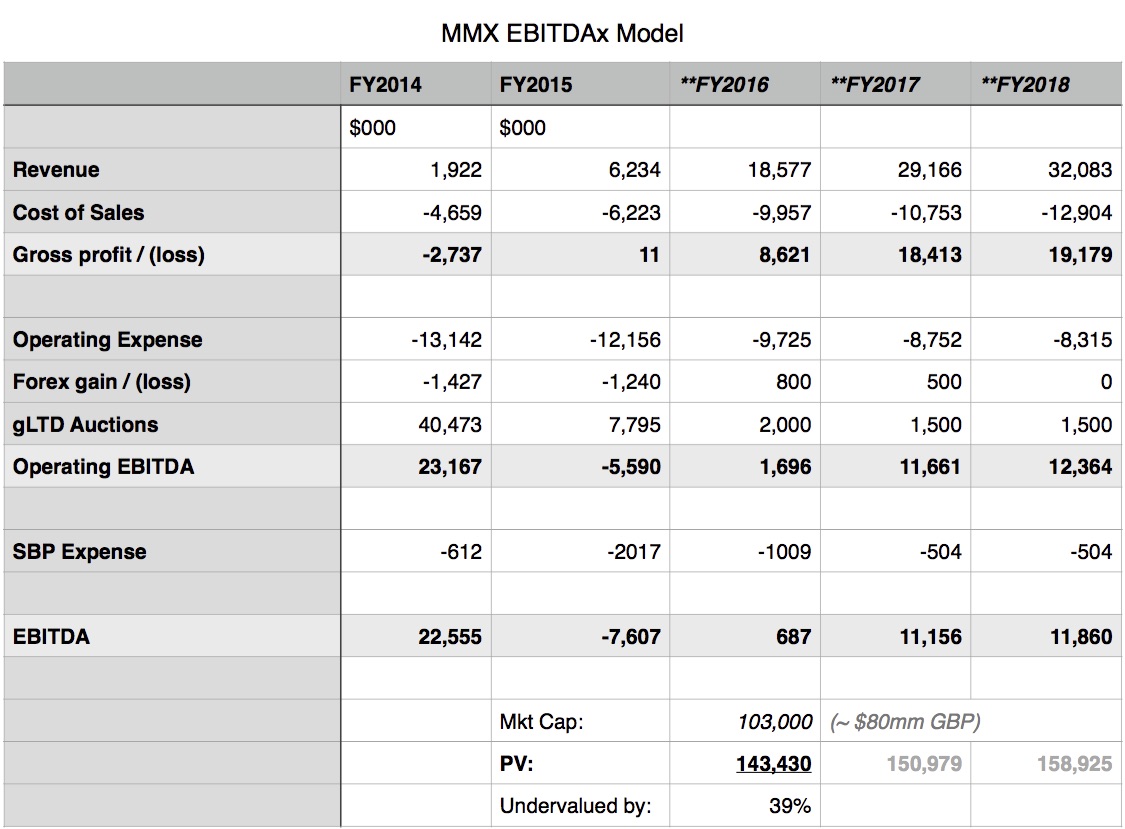

From a quick EBITDA multiple model, this provides an indication that MMX is undervalued by approximately 40%. Key assumptions listed below, this as a reasonable model and is certainly not as aggressive as managements views.

- Assumes 50% billings growth, this is below the lower threshold KPI of 75% set by management. FY2016 expected revenue of 8mm in H1. Minimal growth in H2, around 20% annualised growth onwards.

- Insignificant return from gLTD auctions. Potential upside as some of these domains appear hotly contested with Donuts and Google partaking.

- Reasonable reduction and alignment of COS/Opex from reduced headcount and change in business model. Inline with management comments.

- Minimal FX loss or gains. Inline with general expectations around UK market.

- 5% discount rate, valued using a multiple of 13.4x of EBITDA. This multiple sourced from market average of property companies on NZ companies (NB: tech company multiples significantly higher).

Conclusion

The above commentary as well as a strong cash backing, reinvigorated board and strong revenue growth all point towards a solid buy opportunity. The only reported analyst following, N+1 Singer, rates it valued between 11p to 32p based on 20-30 billings growth and a slowly growing cost base post restructuring.