Argo ARB.L raised £25m and listed on the London Stock Exchange in August 2018 as a cryptocurrency ‘mining as a service’ (MaaS). In August 2018 bitcoin (BTC) was trading for c. $7K USD (compared to c. $20k at peak in 2017) and business seemed to be going OK, signing a few customers and building momentum. However shortly after this support fell from the cryptocurrency market with prices crashing and sitting at around $3k USD. Mining was not particularly profitable and the cryptocurrency market fell deep into the ‘Crypto Winter’.

Argo appeared to be somewhat dead in the water:

- The original ‘mining as a service’ offering was dwindling and ‘suspended’ in April 2019

- Mining on your own account was not highly profitable due to low cryptocurrency prices.

- Significant cash holdings (£15m in April 2019).

- Depressed share price.

- No clear direction from management (aside from mining on own account which was expected to be EBITDA break even.

Come April there was a bit of media attention when Frank Timis tried to oust the directors after he acquired a 14% stake in the company. The mandate seemed somewhat reasonable and perhaps could have been considered a breach of fiduciary responsibility of the directors; return cash and repurpose the remaining shell company. Clearly the original intention of the IPO (‘mining as a service’ for cryptocurrencies) was no longer feasible and the business should be wound up if there was no cryptocurrency resurgence.

However since then there appears to be a bit of resurgence in crypto with Bitcoin prices touching $13k USD. All of a sudden ARB could be EBITDA positive and worth more than simply liquidation value.

So, the question is, does this change in business model and appreciation of cryptocurrency represent a value opportunity?

From perusing the management new announcement we can get a sense of the dynamics of the new business model and burn rate.

March 2019 Trading Update (source)

-

£15m in cash at 31 March 2019

-

Expected to incur a loss for first half of the year. Based on prior period run-rate, this should be less than £2m. We can assume some impact from revenue growth rate and some input from mining on account.

May 2019 Trading Update (source)

- Expected to have 400 BTC on balance sheet by end of Q2 (30 June 2019). Assumed at a price of $4.5k per BTC.

- Mining costs of 0.3m for the period.

- Capex of 1.7m for 1000 S17s for commission in early July. In addition to existing 1000x Z11 miners.

- Share swap with HIVE TSX which values Argo at 11.6p /share.

Assumed cash balance of c. £13m (after acquisition of new miners and mining costs.)

June 2019 Trading Update (source)

- S17 miners arrived earlier than expected and are in service from June 2019

- An additional £2.85m of capex has been deployed for purchase of additional mining equipment expected to enter production in Q2/Q3 2019.

- Expects to generate £0.7m of assets in May (at a BTC price of $8.5k). Cash costs were £0.3m.

- Now forecasting to have 420 BTC of crypto assets on balance sheet at end of Q2 (from 400 BTC forecast announced in May).

- Investment in GPU.ONE; should lower energy supply costs in future.

Assumed cash balance of c. £9.5m (after capex for new miners and mining costs.)

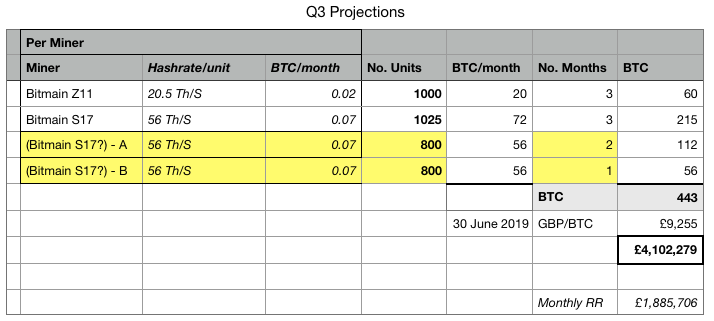

Therfore in July we can expect the following miners to be operational:

- 1000x Z11 miners

- 1025x S17 miners

- A portion of the £2.35m of miners contracted in June 2019 announcement.

Estimated value at 30 June 2019

Assuming not a going concern.

- Cash balance => £9.5m.

- 420 BTC => £4m.

- 1000x Z11 miners @ US$1250 each => £1m (current market value)

- 1025x S17 miners @ US$2000 each => £2m (current market value)

- Open contract for further miners => £2.85m of miners.

- Investment in HIVE.TSX => £4m (pending).

- Investment in GPU.one => £1.5m (pending).

This gives a total value on hand of c. £25m compared to the market cap of c. £25m.

Forecast H2 Trading

However the real magic happens when we start thinking about what will happen in H2.

Based on a few assumptions:

- Assume the £2.85m deployed was for additional S17 units at market price.

- These units are delivered and installed at end of July and August in equal batches.

- Constant BTC price of c. £9k /BTC. (NB: hedging discussion below)

- No increase in mining difficulty.

The at the end of Q3 there should be a total of 860 BTC on balance sheet at a cash cost of c. £0.9m. Assuming no further capex, the closing cash position should be c. £9.5m. The gross margin run-rate (assuming no further capex) should be c. £1.40m of crypto assets on a monthly basis (c. 200 BTC). This is after considering operating costs which I would (conservatively) estimate to be c. £0.45m per month.

*Overhead costs have been difficult to understand based on management updates on what exactly is included in operating costs. We would generally expect the majority of costs to be due to power costs. Assuming a cost of US$0.1/kwh, we should see a c. £150,000 per month increase in operating costs due to power consumption alone from the additional miners on contract. This includes some savings from the new deal signed with GPU.one.

The annual report is not entirely useful in understanding what costs relate to the IPO (one-off in nature) and what are required while operating the current business model of mining on-account rather than operating a MaaS platform.

Therfore, at the end of FY19, ARB should be able to clear £16.8m of gross margin and end with a closing cash balance of c. ~£8m cash balance assuming no further hardware purchases. This assumes that operating costs are paid by liquidating crypto assets. Obviously if management decide to invest in more mining hardware, these numbers will move around etc.

There are a number of significant risks:

- BTC could depreciate. I understand, from anecdotal chatter, that management hedge half of crypto balances using fiat-coins or cash.

- Mining difficulty increases substantially. This looks highly likely which would effectively mean the yield decreases by ~ 5-10% per month in the near future. This may be partially offset by a growth in value of BTC (see below for further).

- Security of wallets/stores; ensure no breach of wallets etc.

- Excessive management overhead. This should be a lean business model and overheads should reflect this however are at risk from excessive overheads.

- Depreciation not fairly reflected (see mining difficulty).

However there are a few upsides:

- BTC/crypto remains stable and/or continues to appreciate.

- MaaS becomes a valid business model and ARB can successfully pivot back into this model.

- Industry consolidation.

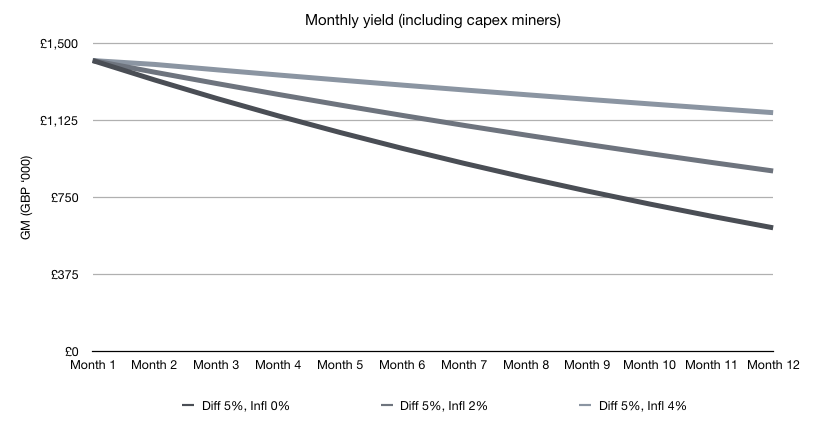

Mining Difficulty - Impact on Yield

Bitcoin mining difficulty increases as amount of mining capacity (# miners) in the network increases. An increase in mining difficulty means a lower yield (i.e less bitcoin). This is generally revised every ~ 14 days for BTC and varies for other cryptocurrencies depending on mechanics.

The mining capacity as at June 2019 is higher than it has ever been (record heights). A number of large China based miners are supposedly rapidly rebuilding capacity which is likely to increase mining capacity further.

If we take a step back; an equilibrium amount of mining capacity should exist when the miner returns would equal to mining costs (including energy costs, depreciation etc). As the mining difficulty increases, the return to miners would increase and be driven by inflation of cryptocurrency (i.e increase in value of underlying cryptocurrency).

There should theoretically be a link between mining difficulty and value of the underlying cryptocurrency in fiat. However this assumes a rationale market.

This point appears largely overlooked and has the potential to severely impact yield going forwards. This is compounded by the efficiency of older mining equipment.

The chart below shows a few points to demonstrate just how damaging the increase in mining difficulty can have on overall yield of ARB’s miners (NB: includes only miners within capex disclosed at June 2019).

It is unclear how this difficulty is reflected in the depreciation rate of the miners. The three year assumption in the annual report appears acceptable at the moment but could prove too optimistic.

Is this a sustainable business model?

I have my doubts on whether mining is a sustainable business model for ARB. In order the be truly sustainable you need some sort of competitive advantage. In terms of mining this could come from:

- Cheaper access to power (i.e. enable higher net yield per miner)

- Access to better mining hardware (i.e. better ASICs)

Bitmain designs and manufactures mining hardware purchased by ARB. They also run their own mining operations where feasible. Other miners in China often have power costs advantages by situating mining facilities alongside hydroelectric plants. It is unclear what a publicly listed company like ARB has in terms of competitive advantage.

Perhaps there is some advantage over the short-term at least. However I suspect ARB will need to pivot back to MaaS.

What’s next?

Management are due to provide another trading update in early July. Ideally, this should include:

- Strategy to reopen MaaS service (update on current status).

- Confirm hedging policy and justify why it is appropriate for BTC.

- Confirm cash management strategy (continued draw-down of cash?)

- Confirm go-forward operating cost base (what is salaries vs what is pure energy costs).

- Confirm contractual arrangements and delivery dates for the £2.85m of capex.