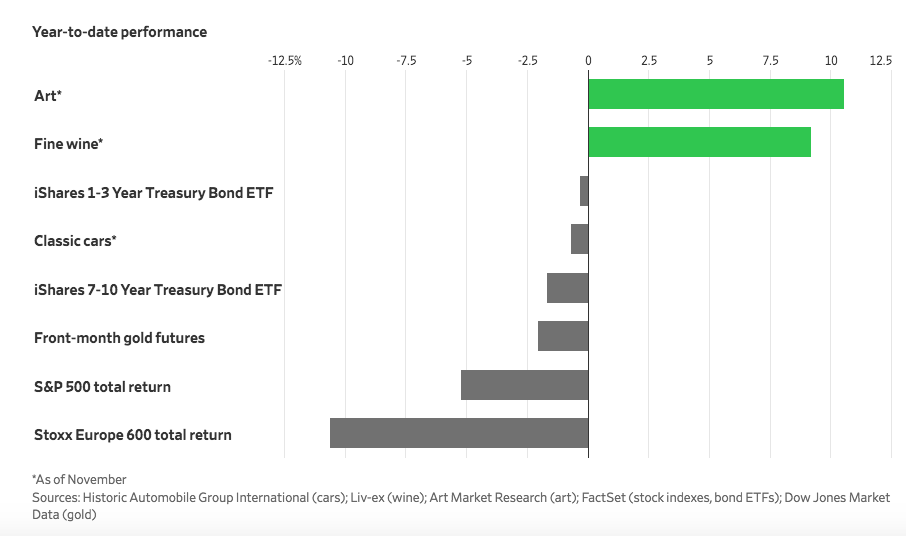

The top-perfoming asset classes over the last decade have been alternative investments. These are assets such as fine wine and spirits, art and even classic cars. These investments have even outperformed the average hedge fund.

Art, wine and collectible cars - better investments than the stock market - 2018

These markets have typically only been accessible by qualified investors (generally restricted to those with high net wealth).

Over the last few years there has been an emergence of online platforms which allow the average public individual to invest in these alternative asset classes. The typical pitch revolves around allowing retail investors access to these ‘great investment opportunities’ (previously only available to high net wealth individuals) and making the investing process ‘fun and easy’, often via mobile app or slick online interface. These platforms are using technology to reach customers and automate administration processes while complying with regulatory requirements.

There is a substantial opportunity here, however there are a number of significant challenges facing platform operators and their prospective customers (i.e. the public).

Customer acquisition is the largest cost

Most people would be surprised that marketing is likely one of the largest costs of these platforms. Particularly as most of these investments are pitching with low minimum investment amounts (Invest in classic cars for as little as $50.). I suspect most of the VC money is going to large online ad spend to prove out customer acquisition strategies.

For a typical commercial real estate syndicate, marketing costs could be as much as 5-10% of the total equity raise (and note these are often leveraged 1-2x).

In addition, if a secondary market is being operated, further marketing costs may be required to support this market.

Scale is needed for administrative efficiency

When a platform bundles an asset for sale, these are generally setup as a type of ‘microfund’ with legal and administrative costs attached to the ‘microfund’. Administration costs are surprisingly large for fund management in general, largely due to compliance costs, which is why it often does not make sense to raise such a small value of capital for such a small asset. These platforms are aiming to use technology to standardise and reduce administrative costs. However some of these administration costs are not straight forward to automate:

Administration costs are include:

- Onboarding customers (completing any KYC checks)

- Payment fees (converting fiat money into ‘shares’ (and back again on sale))

- Operating a market to buy/sell shares.

- Maintenance (operating expenses to maintain the underlying asset - i.e. storage, security, insurance in the case of a classic car)

Liquidity

Liquidity, the ease of which someone can buy or sell a ‘share’ in an asset without price slippage is a key risk and concern for investors.

At some point an investor will want to realise the gain or loss and will need to sell their ‘share’ of an asset. Marketplaces will incurr additional customer acquisition costs in finding customers for these secondary markets.

Platforms have typically approached secondary trading in a number of ways:

- Operate a platform allowing trading throughout the year (i.e. StockX)

- Operate a ‘trading window’ for ‘share’ sales several times a year (i.e. RallyRd)

- Don’t operate a secondary platform or have a platform ‘coming soon’ (i.e. Otis)

Note, that all of these shares have ‘lock-in’ to the platform and trading has to go through the underlying platform (and potential for ongoing commission for the platform?). The ‘blockchain’ way of thinking would be to allow portability between networks. But blockchain is a discussion for another day…

Integrity and valuation

Who owns the underlying asset from a legal perspective? Does the asset have any (debt or other) obligations attached to it (security agreements etc)?

A lot of these assets have minimal liquidity, for instance there aren’t that many 1963 Ferrari 250GT Lussos in existence, therefore the valuation of these assets can become quite hard to determine. Often what a valuer thinks the asset is worth and what the asset can be sold for can be two quite different numbers.

The legacy approach would be to utilise an auditor to report independently on the existence of an asset and rely on a specialist valuer to support the valuation of an asset and perhaps allowing for some sensitivity in valuation. There is a strong incentive, particularly in an opaque market, for platforms to manipulate asset revaluations of these assets in order to show ‘high returns’ and drive further investment.

There is an market opportunity to use other tools to prove existence and valuation of an asset. For instance existence of an asset could be provided through an independent third party (not necessarily an auditor) or through more alternative means (timestamped photos/videos) and valuation proved through historical independently sourced data.

Fun vs Performance

The majority of these platforms are pitching investments with the emphasis on fun rather than outperformance of other investment categories. The reason is likely clear, these asset classes may not continue to outperform the market. The recent outperformance of these assets could be due to the current stage of the economic cycle (peak?) and global economic trends (wealth creation in Asia?). The ‘best’ assets are likely still being acquired directly by high net wealth individuals who have the investment capabilities and nous to allocate their funds efficiently.

As these platforms face large customer acquisition costs (see above) it is crucial that these platforms received continued and ongoing investments from their onboarded investors. If returns do not continue to outperform other asset classes there is a risk that investors will turn away from these platforms as they can get a better return elsewhere (and perhaps with a ‘lower risk’ profile too). The promise of ‘fun’ for investing is only likely to get the platforms so far…

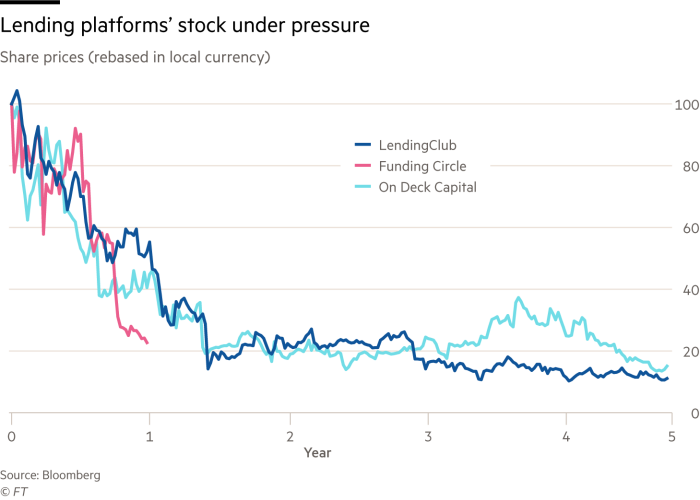

A comparison to P2P lending?

P2P lending is a sector which had great hype earlier in the decade. Connect borrowers and lenders using an online platform and make it better for all - offer cheaper interest rates and reduce defaults. However the majority of P2P lenders have not lived up to the hype.

Some of these P2P lenders have found that it is cheaper to use institutional money rather than money private lenders (after considering lender acquisition costs) to fund loans. Could the same be considered for alternative investments? Would these platforms be more profitable if they only/primarily serve qualified investors which are likely both cheaper to acquire and easier to serve? In which case, where is the real innovation? Is the innovation simply fund managers with a technology driven back-office?

Closing thoughts

Success of these platforms will depend on a number of factors. Picking good quality assets which appreciate well, acquiring customers in an affordable manner and exercising high quality governance and valuation principles.

I for one will be watching eagerly.

Companies of interest

Otis ‘Ability to invest in contemporary art, sneakers, and collectibles for as little as $25.’

RallyRd ‘Invest in classic cars for as little as $50 per share, on Rally Rd.’

Masterworks ‘Masterworks allows anyone to purchase and trade shares in iconic artworks.’

StockX ‘Marketplace for buying and selling sneakers, watches, handbags, and streetwear.’