Hipgnosis has recently been attracting media attention after entry to the main market of the London Stock Exchange under the catchy ticker SONG.

Hipgnosis is an investment vehicle for songs and musical intellectual property. Admission to the main market was completed in November 2019 with a total raise of ~£625m which is quickly being deployed into acquiring catalogues.

The current portfolio of catalogues cover over 6,000 songs of which more than 1,000 have been number one or two on the global charts. The catalogues include The Chainsmokers (14th most streamed artist globally on Spotify), including the song 1-800-273-8255 which was nominated for ‘Song of the Year’ at the 2018 Grammy Awards. There are a plethora of other artists across genres and generations including Al Jackson Jr, Jack Antonoff and Timbaland to name a few.

The general investment rationale is that streaming services, such as Spotify, have made it easier to monetise these rights. In addition there is opportunity to manage and distribute a catalogue more effectively and efficiently than traditional publishers.

Highlights:

- Music revenues are on an upward trend, driven by streaming revenues.

- Technology improves collectability of revenue.

- Unique relationship with Kobalt will enable optimisation of revenue collection.

- Dedicated and more pro-active management will enable growth of synchronisation revenues.

- Broadly pitched to investors as an income stock with a target dividend yield of 5%.

Monetising the ‘long tail’

Beyond a pure income investment, there is perhaps capital growth which can be unlocked from the catalogues themselves.

The key in releasing value from each catalogue is likely to come from three factors:

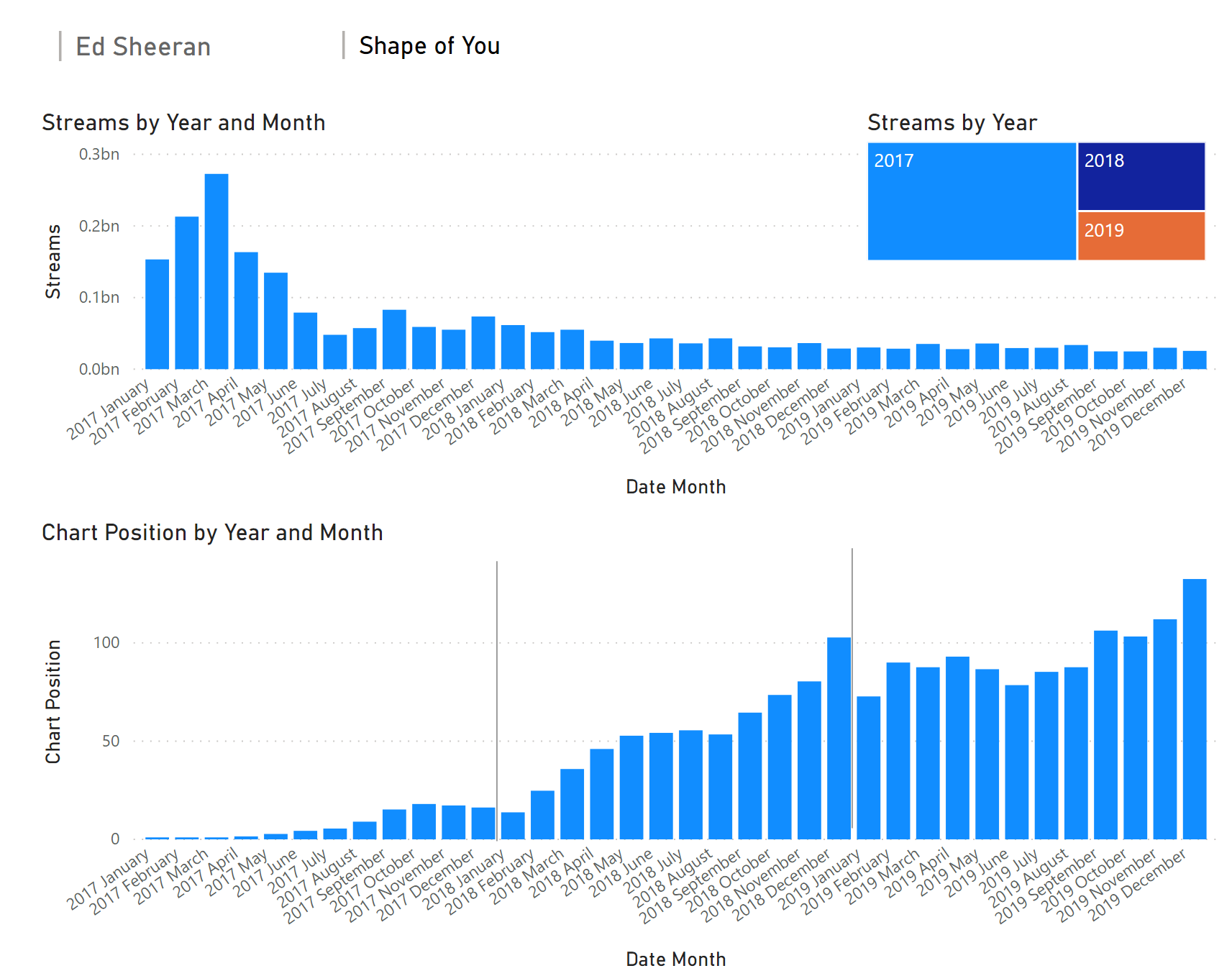

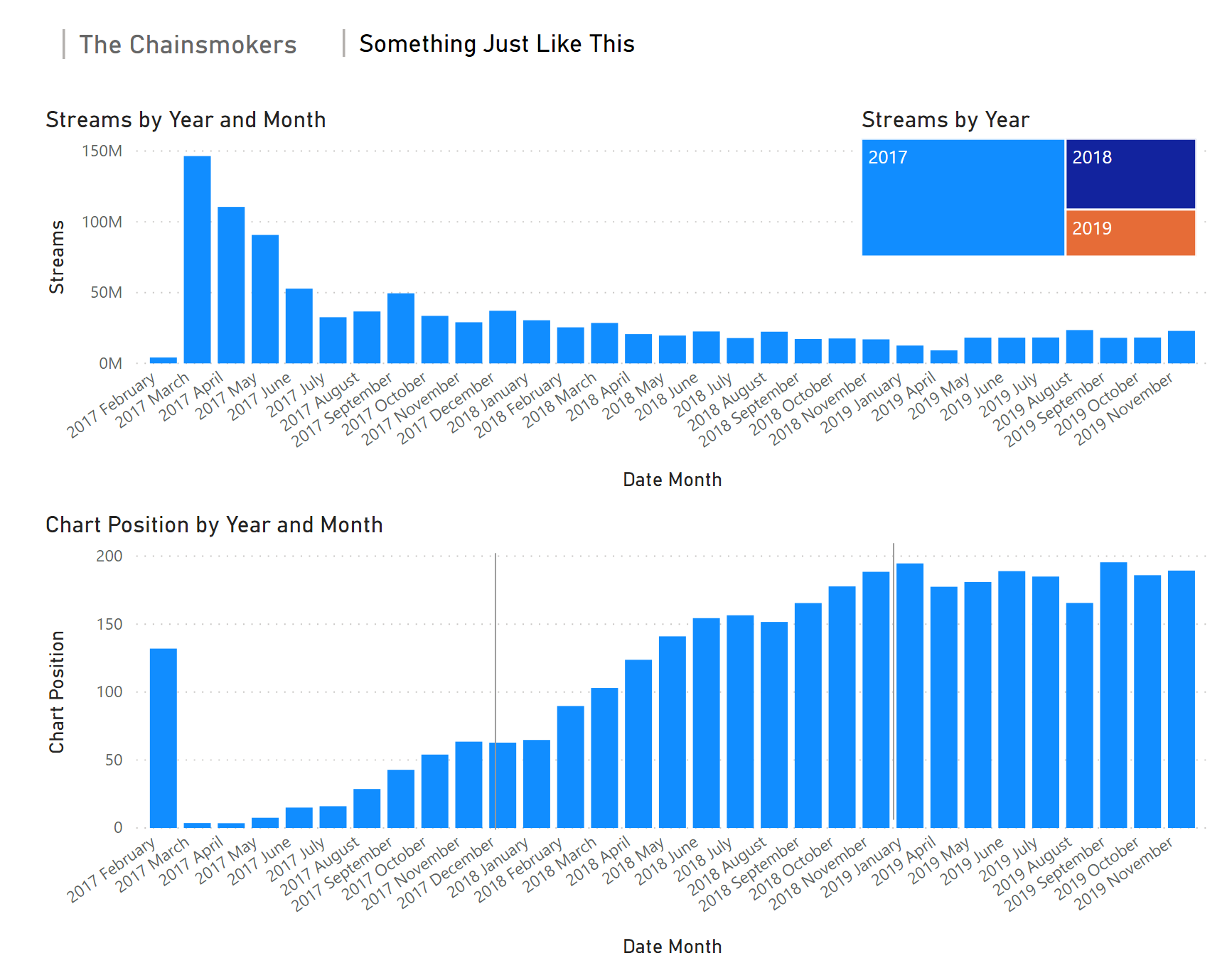

Increase value per stream. From the analysis below, the vast majority of streams occurs in the first quarter of a release but there is a significant ‘long tail’ of streams, which appears reasonably stable over a three year period analysed. This value could be considered the ‘terminal value’. This ‘terminal value’ is at a higher margin due to the scale achieved by Hipgnosis and from leveraging the special relationship with Kobalt.

Increase number of streams. As the shift from purchasing media (i.e through iTunes or on physical media) to a streaming model this may increase the discoverability of a song and increase the number of streams per catalogue. Data analysis presented below suggests this may not be unrealistic

Grow synchronisation revenue. In addition there is a strong suggestion that an increase in synchronisation revenue is possible from better management focus, which may be achievable given the singular focus of Hipgnosis compared with a traditional record label.

Supporting data

I downloaded the weekly Spotify chart data and looked at trends for two songs in Hipgnosis catalogues.

The most interesting feature of this analysis is the ‘long tail’ of streams. Good quality songs appear to produce a stable number of streams in the long term period (or at least over three years). This may also be due to the ongoing growth of streaming, in which case the underlying chart position may be a more relevant metric. It would be very interesting to repeat this analysis in a few years once a larger time period is available.

Spotify weekly chart data for Shape of You (Ed Sheeran) part of the Johnny McDaid catalogue owned by Hipgnosis.

Spotify weekly chart data for Something Just Like This (The Chainsmokers) part of the Chainsmokers catalogue acquired by Hipgnosis in August 2019.